UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ý

Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | |

| ý | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

| | |

| Phunware, Inc. |

| (Name of Registrant as Specified In Its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | |

| ý | No fee required. |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

1002 West Avenue

Austin, Texas 78701

November [__], 2023

Dear Stockholder:

You are cordially invited to attend the 2023 Annual Meeting of Stockholders (the "Annual Meeting") of Phunware, Inc. to be held on December 20, 2023 at 11:00 a.m. Eastern Time. The Annual Meeting will be a virtual meeting of stockholders, which will be conducted via a live audio webcast. Instructions on how to attend the Annual Meeting are posted at www.proxydocs.com/PHUN. Prior registration to attend the Annual Meeting is required. Stockholders must register to attend the Annual Meeting at www.proxydocs.com/PHUN. Only stockholders who held shares at the close of business on the record date, October 26, 2023, may vote at the Annual Meeting, including any adjournment thereof.

The matters expected to be acted upon at the Annual Meeting are described in detail in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement.

You may cast your vote by proxy over the Internet or by telephone to ensure your shares will be represented. Your vote by proxy will ensure your representation at the Annual Meeting regardless of whether or not you attend in person. Returning the proxy does not deprive you of your right to attend the Annual Meeting and to vote your shares in person.

We look forward to your attendance at the Annual Meeting.

Sincerely yours,

| | | | | | | | |

| /s/ Michael Snavely | | /s/ Ryan Costello |

| Michael Snavely | | Ryan Costello |

| Director and Chief Executive Officer | | Chairperson of the Board of Directors |

1002 West Avenue

Austin, Texas 78701

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Virtual Meeting Only - No Physical Meeting Location

To Be Held On December 20, 2023

Dear Stockholder:

You are cordially invited to attend the 2023 Annual Meeting of Stockholders (the "Annual Meeting") of Phunware, Inc., a Delaware corporation (the "Company"), which will be held on Wednesday, December 20, 2023 at 11:00 a.m. Eastern Time. The Annual Meeting will be a virtual meeting of stockholders, which will be conducted via a live audio webcast. In order to attend the Annual Meeting, you must register in advance at www.proxydocs.com/PHUN.

At the Annual Meeting, stockholders will vote on the following matters:

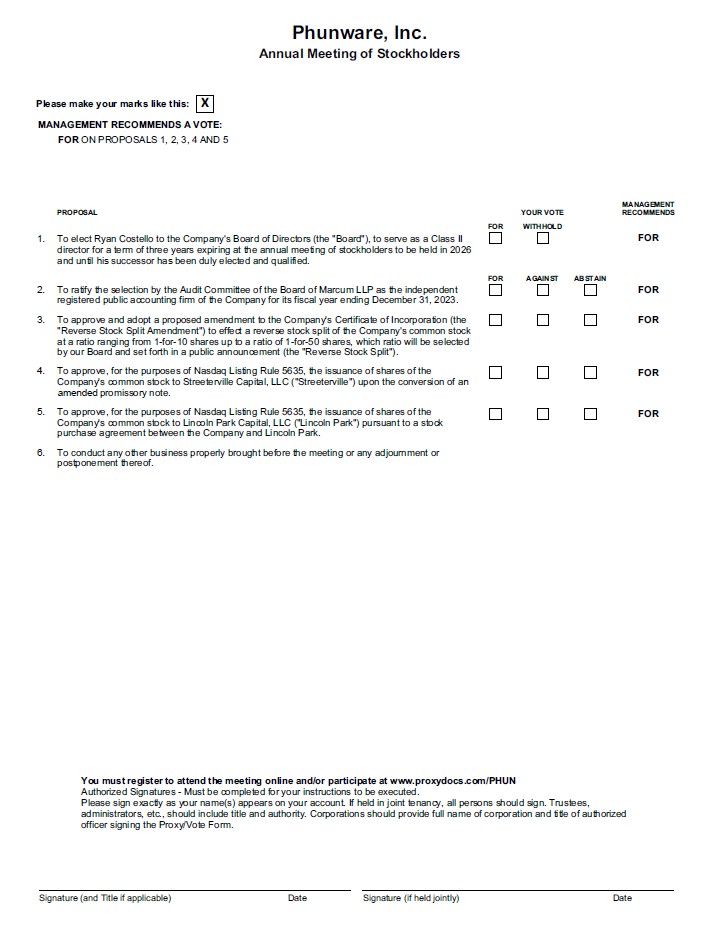

1.To elect one director to the Company's Board of Directors (the "Board"), to serve as a Class II director for a term of three years expiring at the annual meeting of stockholders to be held in 2026 and until their successor has been duly elected and qualified.

2.To ratify the selection by the Audit Committee of the Board of Marcum LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2023.

3.To approve and adopt a proposed amendment to the Company's Certificate of Incorporation (the "Reverse Stock Split Amendment") to effect a reverse stock split of the Company's common stock at a ratio ranging from 1-for-10 shares up to a ratio of 1-for-50 shares, which ratio will be selected by our Board and set forth in a public announcement (the "Reverse Stock Split").

4.To approve, for the purposes of Nasdaq Listing Rule 5635, the issuance of shares of the Company's common stock to Streeterville Capital, LLC ("Streeterville") upon the conversion of an amended promissory note.

5.To approve, for the purposes of Nasdaq Listing Rule 5635, the issuance of shares of the Company's common stock to Lincoln Park Capital, LLC ("Lincoln Park") pursuant to a stock purchase agreement between the Company and Lincoln Park.

6.To conduct any other business properly brought before the meeting or any adjournment or postponement thereof.

These items of business are more fully described in the Proxy Statement accompanying this Notice of Annual Meeting of Stockholders.

The record date for the Annual Meeting is October 26, 2023. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

Important Notice Regarding the Availability of Proxy Materials for the Stockholders' Meeting To Be Held On Wednesday, December 20, 2023 at 11:00 a.m. Eastern Time:

The Proxy Statement and the Company’s Annual Report on Form 10-K for its fiscal year ended December 31, 2022 are available online at www.proxydocs.com/PHUN.

You are cordially invited to attend the Annual Meeting, conducted via a live audio webcast, by registering at www.proxydocs.com/PHUN. In order to attend, you must register in advance prior to the meeting.

YOUR VOTE IS VERY IMPORTANT

Whether or not you expect to attend the Annual Meeting, please complete, date, sign and return the enclosed proxy card or vote over the telephone or the Internet as instructed in these materials, as promptly as possible in order to ensure your representation at the Annual Meeting. Even if you have voted by proxy, you may still vote if you attend the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must obtain a proxy issued in your name from that record holder. Even if you have voted by proxy, you may still vote if you attend the Annual Meeting.

The Board of Directors recommends you vote (1) FOR the director nominee, (2) FOR the ratification of the appointment of Marcum LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2023, (3) FOR the approval of the Reverse Stock Split, (4) FOR the issuance of shares to Streeterville and (5) FOR the issuance of shares to Lincoln Park.

| | | | | |

| By Order of the Board of Directors, |

| |

| /s/ Michael Snavely |

| Michael Snavely |

| Director and Chief Executive Officer |

Austin, Texas

November [__], 2023

TABLE OF CONTENTS

1002 West Avenue

Austin, Texas 78701

PROXY STATEMENT

FOR THE 2023 ANNUAL MEETING OF STOCKHOLDERS

Virtual Meeting Only - No Physical Meeting Location

To Be Held On December 20, 2023

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

We are providing you with these proxy materials because the Board of Directors of Phunware, Inc. (the “Board”) is soliciting your proxy to vote at Phunware’s 2023 Annual Meeting of Stockholders (the “Annual Meeting”), including at any adjournments or postponements thereof, to be conducted via a live audio webcast on Wednesday, December 20, 2023 at 11:00 a.m. Eastern Time. The Annual Meeting can be accessed by visiting www.proxydocs.com/PHUN.

You are invited to attend the Annual Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attend the Annual Meeting to vote your shares. Instead, you may simply follow the instructions below to submit your proxy. The proxy materials, including this Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, are being distributed and made available on or about November [__], 2023. As used in this Proxy Statement, references to “we,” “us,” “our,” “Phunware” and the “Company” refer to Phunware, Inc. and its subsidiaries.

Why did I receive a notice regarding the availability of proxy materials on the internet?

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the Internet. Accordingly, we have sent you a Notice of Internet Availability of Proxy Materials (the “Notice”) because the Board is soliciting your proxy to vote at the Annual Meeting, including at any adjournments or postponements of the meeting. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice.

We will begin distributing the Notices on or about November [__], 2023 to all stockholders of record entitled to vote at the Annual Meeting.

What proxy materials are available on the Internet?

This Proxy Statement and the Annual Report on Form 10-K for the fiscal year ended December 31, 2022 are available at www.proxydocs.com/PHUN.

How do I attend the Annual Meeting?

This year’s Annual Meeting will be held entirely online via a live audio webcast which will begin promptly at 11:00 a.m. Eastern Time on Wednesday, December 20, 2023. Stockholders may vote while connected to the Annual Meeting.

In order to attend the Annual Meeting, you must register in advance at www.proxydocs.com/PHUN. Upon completing your registration, you will receive further instructions via email, including your unique link that will allow you access to the Annual Meeting. Please be sure to follow the instructions found on your proxy card and subsequent instructions that will be delivered to your email one (1) hour prior to the start of the Annual Meeting.

Who can vote at the Annual Meeting?

If you are a stockholder of record as of the record date, October 26, 2023, you may vote your shares by following the instructions provided on the Notice to log in to www.proxydocs.com/PHUN. You will be asked to provide the control number from your Notice.

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you must obtain a valid proxy from your broker, bank or other agent to vote online during the Annual Meeting. Follow the instructions from your broker or bank included with these proxy materials or contact your broker or bank to request a proxy form.

Vote by Proxy

Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend and vote at the Annual Meeting even if you have already voted by proxy.

If you are a stockholder of record, you may vote by proxy over the telephone or through the Internet:

1.To vote over the telephone, dial toll-free 1-866-363-3966 and follow the recorded instructions. You will be asked to provide the control number from the Notice.

2.To vote through the Internet, go to www.proxydocs.com/PHUN to complete an electronic proxy card. You will be asked to provide the control number from the Notice.

We are providing Internet voting to provide expanded access and to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your voting instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

Stockholder of Record: Shares Registered in Your Name

If on the record date, October 26, 2023, your shares were registered directly in your name with Phunware’s transfer agent, Continental Stock Transfer & Trust Company, LLC, then you are a stockholder of record. As a stockholder of record, you may vote at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on the record date, October 26, 2023, your shares were held not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares at the meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are currently five matters scheduled for a vote:

1.Election of one director to the Board, to serve as a Class II director for a term of three years expiring at the annual meeting of stockholders to be held in 2026 and until their successor has been duly elected and qualified;

2.Ratification of the selection by the Audit Committee of the Board of Marcum LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2023;

3.Approval of an amendment to the Company's Certificate of Incorporation to effect a reverse stock split of the Company's common stock at a ratio ranging from 1-for-10 shares up to a ratio of 1-for-50 shares, which ratio will be selected by our Board;

4.Approval of the issuance of shares of the Company's common stock to Streeterville Capital, LLC ("Streeterville") for the purposes of Nasdaq Listing Rule 5635; and

5.Approval of the issuance of shares of the Company's common stock to Lincoln Park Capital, LLC ("Lincoln Park") for the purposes of Nasdaq Listing Rule 5635.

What if another matter is properly brought before the meeting?

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How many votes do I have?

Stockholders of Record: Shares Registered in Your Name

On each matter to be voted upon, you have one vote for each share of common stock you own as of the record date, October 26, 2023. On the record date, there were 133,270,351 shares of common stock outstanding and entitled to vote.

What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote by proxy over the telephone, through the Internet, or at the Annual Meeting, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other nominee, and you do not provide the broker or other nominee that holds your shares with voting instructions, the broker or other nominee will determine if it has the discretionary authority to vote on the particular matter.

What if I vote but do not make specific choices?

If you vote without marking voting selections, the shares represented by your proxy will be voted as recommended by the Board. If any other matter is properly presented at the Annual Meeting, your proxyholder will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies online, by telephone or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the Notices to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes, you can revoke your proxy at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

1.You may grant a subsequent proxy by telephone or through the Internet.

2.You may send a timely written notice that you are revoking your proxy to Phunware’s Secretary at 1002 West Avenue, Austin, Texas 78701.

3.You may attend the Annual Meeting and vote in-person. Simply attending the meeting will not, by itself, revoke your proxy.

Your most current telephone or Internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

When are stockholder proposals and director nominations due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials within the processes of Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), your proposal must be submitted in writing not later than June [__], 2024 to Phunware’s Secretary at 1002 West Avenue, Austin, Texas 78701 and comply with all applicable requirements of Rule 14a-8.

Proposals of stockholders of the Company that are intended to be presented by such stockholders at the 2024 Annual Meeting of Stockholders, as well as nominations of persons for election as directors of the Company at the 2024 Annual Meeting of Stockholders, must be submitted in writing not earlier than August [__], 2024 and not later than September [__], 2024 to Phunware’s Secretary at 1002 West Avenue, Austin, Texas 78701 and comply with the requirements in the Company’s Amended and Restated Bylaws. However, if our 2024 Annual Meeting of Stockholders is held before November 20, 2024 or after February 18, 2025, then the deadline is not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of (i) the 90th day prior to such annual meeting, or (ii) the tenth day following the day on which Public Announcement (as defined in our Amended and Restated Bylaws) of the date of such annual meeting is first made.

You are also advised to review our Amended and Restated Bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations. The Company suggests that any such proposal be sent by certified mail, return receipt requested.

In addition to satisfying the foregoing requirements under our Amended and Restated Bylaws, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than the Company's

nominees for our 2024 Annual Meeting of Stockholders must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than October 21, 2024.

How are votes counted?

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count, with respect to Proposal 1, votes “For,” “Withhold” and broker non-votes, and, with respect to Proposals 2, 3, 4 and 5, votes “For,” “Against,” abstentions and, if applicable, broker non-votes.

What are “broker non-votes”?

If you are a beneficial owner whose shares are held of record by a broker, you must instruct the broker how to vote your shares. If you do not provide voting instructions, your shares will not be voted on any proposal on which the broker does not have discretionary authority to vote. This is called a “broker non-vote.” In these cases, the broker can register your shares as being present at the Annual Meeting for purposes of determining the presence of a quorum but will not be able to vote on those matters for which specific authorization is required.

If you are a beneficial owner whose shares are held of record by a broker, your broker has discretionary voting authority to vote your shares on Proposal No. 2, the ratification of Marcum, LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2023, even if the broker does not receive voting instructions from you. However, your broker does not have discretionary authority to vote on Proposal No. 1, the election of a Class II director, Proposal 3, approval of the reverse stock split amendment, Proposal 4, approval of the issuance of common stock to Streeterville for purposes of Nasdaq Rule 5635, or Proposal 5, approval of the issuance of common stock to Lincoln Park for purposes of Nasdaq Rule 5635.

How many votes are needed to approve each proposal?

| | | | | | | | | | | | | | |

| Proposal | | Vote Required | | Broker Discretionary Voting Allowed |

| 1. Election of Class II director | | Plurality of votes cast | | No |

| 2. Ratification of Marcum LLP | | Majority of votes cast | | Yes |

| 3. Approval of the Reverse Stock Split Amendment | | Majority of votes cast | | No |

| 4. Approval of the issuance of common stock to Streeterville for purposes of Nasdaq Rule 5635 | | Majority of votes cast | | No |

| 5. Approval of the issuance of common stock to Lincoln Park for purposes of Nasdaq Rule 5635 | | Majority of votes cast | | No |

For Proposal 1, the election of a Class II director, the nominee receiving the most “For” votes from the holders of shares present at the Annual Meeting or represented by proxy and entitled to vote on the election of directors will be elected. Only votes “For” will affect the outcome. There is no "Against" option and votes that are "withheld" or not cast, including broker non-votes, are not counted as votes "For" or "Against."

To be approved, Proposals 2, 3, 4 and 5 must receive “For” votes from the holders of a majority of shares present at the Annual Meeting or represented by proxy and entitled to vote on the matter. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect and will not be counted in determining the number of shares necessary for approval.

Dissenters' rights are not applicable to any of the matters being voted upon at the Annual Meeting.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least one-third of the outstanding shares entitled to vote are present at the Annual Meeting or represented by proxy. On the record date, October 26, 2023, there were 133,270,351 shares outstanding and entitled to vote. Thus, the holders of 44,423,451 shares must be present during the Annual Meeting or represented by proxy at the Annual Meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you attend the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the Annual Meeting's chairperson or holders of a majority of shares represented at the Annual Meeting may adjourn the meeting to another date.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a Current Report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four business days after the meeting, we intend to file a Current Report on Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Current Report on Form 8-K to publish the final results.

EXECUTIVE OFFICERS, DIRECTORS, AND CORPORATE GOVERNANCE

The following table sets forth the names, ages and positions of our executive officers, director nominees and directors whose terms will continue after the Annual Meeting:

| | | | | | | | | | | | | | |

| Name | | Age | | Position |

| Executive Officers | | | | |

| Michael Snavely | | 55 | | Chief Executive Officer and Class III Director |

| Troy Reisner | | 56 | | Chief Financial Officer |

| Randall Crowder | | 43 | | Chief Operating Officer |

| Chris Olive | | 53 | | Chief Legal Officer |

| | | | |

| Non-Employee Directors | | | | |

Stephen Chen (1)(2)(3) | | 40 | | Class I Director |

Ryan Costello (1)(2)(3)(4) | | 47 | | Class II Director and Chairperson |

Rahul Mewawalla (1)(2)(3) | | 45 | | Class I Director |

| | | | | |

(1) | Member of the Audit Committee |

(2) | Member of the Compensation Committee |

(3) | Member of the Nominating and Corporate Governance Committee |

(4) | Nominee for election at the Annual Meeting |

Executive Officers

Each of our executive officers serves at the discretion of the Board and will hold office until his successor is duly appointed and qualified or until his earlier resignation or removal. The following biographical descriptions set forth certain information with respect to our executive officers based on information furnished to us by each such officer.

Michael Snavely joined Phunware as its Chief Revenue officer in September 2023 and was appointed as Chief Executive Officer effective October 25, 2023. Mr. Snavely was also appointed to serve as a Class III director effective October 26, 2023 to fill the vacancy left when Russell Buyse resigned as Chief Executive Officer on October 25, 2023 and Class III director on October 26, 2023. Prior to joining Phunware, he served as the General Manager of Vidable AI, a unit of Sonic Foundry (Nasdaq: SOFO) of Madison, Wisconsin since 2022. From 2019 until 2022, Mr Snavely was chief commercial officer at CBANC, which provides a professional network of U.S. banking institutions, the people that work for them and the vendors who serve them. From 2017 to 2018, he was president of Springbox, a growth and transformation consulting firm, which was acquired by Prophet in 2019. From 2016 to 2017, he worked for Tile as a global business development leader. Mr. Snavely was previously employed by Phunware from 2014 to 2016, as the executive vice president of global software sales and marketing. Prior to working at Phunware, he worked at Mutual Mobile (2011 - 2014), Bazaarvoice (2009 - 2011) and The Alliant Group (2007 - 2009), among other roles in his career. Mr. Snavely earned a BA from the College of Wooster in Wooster, Ohio and a J.D. from The Ohio State University. He is licensed (inactive) as an attorney at law in the State of Ohio.

Troy Reisner has served as Phunware's Chief Financial Officer since June 2023. Previously he was the Chief Financial Officer at Keystone Tower Systems, Inc., a manufacturer of wind turbines, headquartered in Denver, Colorado. Prior to joining Keystone in December 2019, Mr. Reisner was a partner with with the public accounting firm of Deloitte & Touche LLP until his retirement in June 2019. In January 2022, he was appointed to the board of CEA Industries, Inc., (Nasdaq: CEAD), which designs, engineers and sells environmental control and other technologies for the controlled environment agriculture industry, where he also serves as chairman of their audit committee and member of their compensation and strategic investments committee. Mr. Reisner earned a B.S. degree in Accounting from Southern Illinois University at Edwardsville, has practiced as a Certified Public Accountant for over 30 years and is licensed (inactive) as a CPA in the State of Missouri.

Randall Crowder has served as Phunware’s Chief Operating Officer since February 2018, and on our Board between December 2018 and September 2022. In September 2017, he founded and continues to serve as the Managing Partner of Nove Ventures, a venture capital firm, which focuses on investing in established companies like Phunware that are seeking to leverage blockchain technology to complement their core business model. Since August 2009, Mr. Crowder has also been a co-founder and Managing Partner at TEXO Ventures, which focuses primarily on tech-enabled health services. Mr. Crowder holds a B.S. in General Management from the United States Military Academy at West Point and an M.B.A. from the McCombs School of Business at the University of Texas at Austin.

Chris Olive joined Phunware in April 2022 as Chief Legal Officer. Prior to his tenure at Phunware, Mr. Olive was a partner at Bracewell LLP in Dallas, Texas, from 2006 to 2022. Mr. Olive brings to Phunware diverse transactional and regulatory experience, in which he has previously represented clients in various capacities in, among other things, complex, bespoke and customized credit facilities, structured financings, swaps and derivatives, insurance finance, corporate acquisitions, financial instrument and commodity purchase and sale and repurchase transactions and related banking, financial and other regulatory matters. He has also served as an associate at Jones Day and served in the United States Army Judge Advocate General’s Corps. Mr. Olive has a BBA in Finance with honors from the University of Miami, a JD from the Southern Methodist University School of Law and an LLM in Banking & Finance Law with distinction from the University of London.

Non-Employee Directors and Nominee

The following biographical descriptions set forth certain information with respect our non-employee directors and the current nominee for election to serve as a non-employee director based on information furnished to us by each such director or nominee.

Stephen Chen, who was elected to serve as a non-employee Class I director in November 2022 is a board-tested operational leader and chief financial officer. Since July 2016, Mr. Chen has served as chief financial officer of Kent Moore Capital, an investment and advisory firm focused on specialty finance, where he also currently sits on the board of directors. Also, since 2016, he has served as chief financial officer of BioIntegrate, a regenerative medicine company. Mr. Chen has been involved in blockchain related projects since 2018, and, in 2021, he co-founded IHBit Global, a diversified blockchain holding company with assets including a crypto exchange, token project, electronic sports team and basketball team. From 2012 to 2016, Mr. Chen was a director for Hudson International, a global private investment firm. From 2008 to 2012, he led the emerging markets investment banking team at Oppenheimer Investments North America. Prior to joining Oppenheimer, Mr. Chen was a Vice President at J.P. Morgan. Mr. Chen has a B.S. degree from Brown University.

We believe Mr. Chen is qualified to serve as a member of our Board because of his expertise in financial services and technology, including blockchain.

Ryan Costello was appointed to serve as a non-employee Class II director of Phunware in September 2021 and serves as our Chairperson. Mr. Costello founded Ryan Costello Strategies, LLC, which provides strategic counsel and advocacy efforts on behalf of companies, trade associations and other organizations seeking to advance their objectives in the legislative and regulatory policy process within the federal government. From January 2015 to January 2019, Mr. Costello served as a member of the U.S. House of Representatives for Pennsylvania's 6th congressional district, where he served on numerous committees and subcommittees, including the Subcommittee on Communications and Technology and the Subcommittee on Digital Commerce and Consumer Protection. Prior to serving in Congress, Mr. Costello was an attorney in private practice representing clients in various facets of law, including regulatory compliance and financing. In October 2023, Mr. Costello was appointed to the board of Mawson Infrastructure Group (Nasdaq: MIGI). From September 2021 to June 2022, Mr. Costello served on the board of Red White & Bloom Brands, Inc. (CSE: RWB and OTCQX: RWBYF), a multi-state cannabis operator. He is certified by the National Association of Corporate Directors, which equips directors with the foundation of knowledge sought by boards to effectively contribute in the boardroom. Mr. Costello is a graduate of Ursinus College, B.A., with honors, and received a JD from Villanova University Charles Widger School of Law.

We believe Mr. Costello is qualified to serve as a member of our Board because of his expertise in law, governmental affairs and technology. Mr. Costello is a nominee for re-election to our Board as a Class II director at the Annual Meeting.

Rahul Mewawalla was appointed to serve as a non-employee Class I director of Phunware in September 2021. Mr. Mewawalla is a technology, digital, product, and business leader with extensive strategic and operational leadership expertise across technology, internet, software, telecommunications, financial services, media, consumer, enterprise, digital and blockchain companies. He has held several executive leadership roles, and currently serves as Chief Executive Officer and President of Mawson Infrastructure Group Inc., a digital infrastructure company and previously served as Chief Executive Officer and President of Xpanse Inc., a software, technology and fintech company from 2020 to 2021, as Chief Digital Officer and Executive Vice President, Platforms and Technology Businesses at Freedom Mortgage Corporation, a national financial services company from 2020 to 2021, as Chief Executive Officer and President at Zenplace Inc., a software-as-a-service and technology platforms company from 2014 to 2020, as Vice President at Nokia Corporation, a global technology and telecommunications company from 2010 to 2012, as Vice President at General Electric Company’s NBCUniversal, a global media, entertainment and diversified company from 2008 to 2010, and as Senior Director at Yahoo! Inc., a global internet and technology company from 2005 to 2008. Mr. Mewawalla has served as a board director with numerous NASDAQ-listed public companies, including as Chairman of the Board, Board Committee Chairman, Chairman of the Audit Committee, Chairman of the Compensation Committee, Nominating and Governance Committee Member, Special Committee Member, Strategic Transactions Committee Member and Board Director at publicly traded companies, including at Rocky Mountain Chocolate Factory Inc (Nasdaq: RMCF), Lion Group Holding (Nasdaq: LGHL), Aquarius II Acquisition Corporation (Nasdaq: AQUB), Four Leaf Acquisition Corporation (Nasdaq: FORL) and Mawson Infrastructure Group, Inc. (Nasdaq: MIGI). Mr. Mewawalla also served as an independent board director at SOS Children’s Villages USA. He has also served as Senior Advisor to the San Francisco Mayor’s Office on Innovation, as Advisor to Stanford University's Persuasive Technology Lab, and as Committee Chair of the VC TaskForce SIG on Systems and Services. Mr. Mewawalla earned an MBA from the Kellogg School of Management at Northwestern University and a BBS from the University of Delhi.

We believe Mr. Mewawalla’s extensive digital, technology, products, platforms, mobile, strategic and operational expertise, as well as his executive leadership experience, qualify him to serve as a director of the Company.

Additional Information

On February 18, 2022, certain stockholders filed a lawsuit against Phunware and its individual officers and directors. The case, captioned Wild Basin Investments, LLC, et al. v. Phunware, Inc., et al., was filed in the Court of Chancery of the state of Delaware (Cause No. 2022-0168-LWW). Plaintiffs alleged that they invested in various early rounds of financing while the Company was private and that Phunware should not have subjected their shares to a 180-day “lock up” period. Among others, Alan Knitowski, Randall Crowder, Matt Aune, Kathy Tan Mayor and Eric Manlunas, each of whom served as executive officers and/or directors as of December 17, 2019 have been named as defendants in the lawsuit. Mr. Knitowski and Mr. Aune's employment terminated with the Company effective December 27, 2022 and June 30, 2023, respectively. Mr. Manlunas resigned from our board effective October 1, 2023 and Ms. Mayor resigned from our board effective October 26, 2023.

CORPORATE GOVERNANCE

Board Composition

Our business affairs are managed under the direction of the Board. The Board currently consists of four members, three of whom qualify as independent within the meaning of the independent director guidelines of the Nasdaq Stock Market ("Nasdaq"). Ms. Mayor resigned as a Class II director effective October 26, 2023 reducing the number of directors who qualify as independent to three. Mr. Snavely serves as an executive officer and is not considered independent.

The Board is divided into three staggered classes of directors. At each annual meeting of stockholders, a class of directors will be elected for a three-year term to succeed the same class whose term is then expiring, as follows:

•the Class I directors are currently Stephen Chen and Rahul Mewawalla, and their terms will expire at the 2025 Annual Meeting of Stockholders;

•the Class II director is currently Ryan Costello, and his term will expire at the Annual Meeting; and

•the Class III director is currently Michael Snavely, who was appointed to fill the seat vacated by Russ Buyse, and his term will expire at the 2024 Annual Meeting of Stockholders.

Mr. Costello is a Class II director nominee for election for a three-year term expiring at the 2026 Annual Meeting of Stockholders. Ms. Mayor resigned as a Class II director effective October 26, 2023.

Our Certificate of Incorporation and Amended and Restated Bylaws provide that the number of directors shall consist of one or more members and may be increased or decreased from time to time by a resolution of the Board. Each director’s term continues until the election and qualification of his or her successor, or his or her earlier death, resignation or removal. Any increase or decrease in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the total number of directors. This classification of the Board may have the effect of delaying or preventing changes in control of our Company.

Board Diversity Matrix

The following Board Diversity Matrix sets forth our Board diversity statistics in accordance with Nasdaq Rule 5606, based on information self-disclosed to us by each such director:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Board Diversity Matrix (As of October 26, 2023) |

| Total Number of Directors | | 4 |

| | Female | | Male | | Non-Binary | | Did Not Disclose Gender |

| Part I: Gender Identity | | | | | | | | |

| Directors | | | | 4 | | | | |

| Part II: Demographic Background | | | | | | | | |

| African American or Black | | | | | | | | |

| Alaskan Native or Native American | | | | | | | | |

| Asian | | | | 2 | | | | |

| Hispanic or Latinix | | | | | | | | |

| Native Hawaiian or Pacific Islander | | | | | | | | |

| White | | | | 2 | | | | |

| Two or More Races or Ethnicities | | | | | | | | |

| LGBTQ+ | | | | | | | | |

| Did Not Disclose Demographic Background | | | | | | | | |

Meetings of the Board of Directors

Our Board met fourteen times during the 2022 fiscal year. Each incumbent Board member attended 75% or more of the aggregate number of meetings of the Board held during the period for which he or she was a Board member. The Company encourages, but does not require, directors to attend the Annual Meeting. Five Board members attended our 2022 annual meeting of stockholders.

Director Independence

Our common stock and certain warrants to purchase our common stock are listed on Nasdaq. Under the rules of Nasdaq, independent directors must comprise a majority of a listed company’s board of directors. In addition, the rules of Nasdaq require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating

and corporate governance committees be independent. Under the rules of Nasdaq, a director will only qualify as an “independent director” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Exchange Act. Compensation committee members must also satisfy the independence criteria set forth in Rule 10C-1 under the Exchange Act.

We have undertaken a review of the independence of each director and considered whether each director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. As a result of this review, we determined that Messrs. Chen, Costello and Mewawalla representing three of our four directors, are considered “independent directors” as defined under the applicable rules and regulations of the SEC and the listing requirements and rules of Nasdaq. Ms. Mayor resigned as a Class II director effective October 26, 2023 which reduced the number of directors who qualify as independent to three.

Board Leadership Structure / Lead Independent Director

We believe that the structure of our Board and Board committees provides strong overall management. The Chair of our Board and our Chief Executive Officer roles are separate. Mr. Snavely serves as our Chief Executive Officer and Mr. Costello serves as Chair of our Board. This structure enables each person to focus on different aspects of company leadership. Our Chief Executive Officer is responsible for setting the strategic direction of our company, the general management and operation of the business and the guidance and oversight of senior management. The Chair of our Board monitors the content, quality and timeliness of information sent to our Board and is available for consultation with our Board regarding the oversight of its business affairs. Our independent directors bring experience, oversight and expertise from outside of Phunware.

Corporate Governance Guidelines and Code of Business Conduct and Ethics

Our Board has adopted Corporate Governance Guidelines that address items such as the qualifications and responsibilities of our directors and director candidates and corporate governance policies and standards applicable to us in general. In addition, our Board has adopted a Code of Business Conduct and Ethics that applies to all of our employees, officers and directors, including our Chief Executive Officer, Chief Financial Officer, and other executive and senior financial officers. The full text of our Corporate Governance Guidelines and Code of Business Conduct and Ethics is posted on the Governance portion of the investor relations page of our website at https://investors.phunware.com. We will post amendments to our Code of Business Conduct and Ethics or waivers of our Code of Business Conduct and Ethics for directors and executive officers that are required to be disclosed by the rules of the SEC or Nasdaq on the same website.

Board Role in Risk Oversight

The Board recognizes the importance of effective risk oversight in running a successful business and in fulfilling its fiduciary responsibilities to Phunware and its stockholders. While the executive team is responsible for the day-to-day management of risk, one of the Board’s key functions is informed oversight of the Company’s risk management process. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various Board standing committees that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure, including a determination of the nature and level of risk appropriate for the Company. Our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken.

The Audit Committee also reviews with management when appropriate any significant regulatory and legal developments that may have a material impact on Phunware’s financial statements, compliance programs and policies. Our Nominating and Corporate Governance Committee monitors the effectiveness of our corporate governance guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct. Our Compensation

Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking.

Both the Board as a whole and the various standing committees receive periodic reports from our management team that lead a variety of functions across the business, as well as input from external advisors, as appropriate. It is the responsibility of the committee chairs to report findings regarding material risk exposures to the Board as quickly as possible.

Committees of the Board of Directors

The Board has the authority to appoint committees to perform certain management and administrative functions. The Board has an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee, each of which has the composition and responsibilities described below. Members serve on these committees until their resignation or until otherwise determined by the Board.

Committee Meetings

Each incumbent Board member attended 75% or more of the aggregate number of meetings held by all committees of the Board on which he or she served during the fiscal year ended December 31, 2022 during the period for which he or she served.

Audit Committee

We have established a designated standing audit committee. Messrs. Chen, Costello and Mewawalla, each of whom is a non-employee member of the Board, currently comprise our Audit Committee. Mr. Mewawalla is the Chairperson of our Audit Committee. We have determined that each of the members of our Audit Committee satisfies the requirements for independence and financial literacy under the rules of Nasdaq and the SEC. Kathy Tan Mayor, who served on the Audit Committee until her resignation, resigned as a Class II director effective October 26, 2023. During the fiscal year ended December 31, 2022, the committee met four times. The Audit Committee is responsible for, among other things:

•selecting a qualified firm to serve as the independent registered public accounting firm to audit our financial statements;

•helping to ensure the independence and performance of the independent registered public accounting firm;

•discussing the scope and results of the audit with the independent registered public accounting firm and reviewing, with management and the independent registered public accounting firm, our interim and year-end financial statements;

•developing procedures for employees to submit concerns anonymously about questionable accounting or audit matters;

•reviewing the Company’s policies on and overseeing risk assessment and risk management, including enterprise risk management;

•reviewing the adequacy and effectiveness of our internal control policies and procedures and the Company’s disclosure controls and procedures;

•reviewing related person transactions; and

•approving or, as required, pre-approving, all audit and all permissible non-audit services, other than de minimis non-audit services, to be performed by the independent registered public accounting firm.

The Board has adopted a written charter for the Audit Committee that satisfies the applicable rules and regulations of the SEC and the listing standards of Nasdaq. Our Audit Committee charter can be found on the "Governance Documents" section of our Investor Relations website at https://investors.phunware.com/governance-docs.

Audit Committee Report

The following Report of the Audit Committee of the Company shall not be deemed to be “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of

1933, as amended or the Exchange Act, except to the extent that the Company specifically incorporates such information by reference in such filing.

The Audit Committee has reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2022 with management of the Company. The Audit Committee has discussed with the Company’s independent registered public accounting firm, Marcum LLP the matters required to be discussed by Auditing Standard No. 1301, Communications with Audit Committees, as adopted by the Public Company Accounting Oversight Board (“PCAOB”). The Audit Committee has also received the written disclosures and the letter from Marcum LLP required by applicable requirements of the PCAOB regarding the independent accountants’ communications with the Audit Committee concerning independence, and has discussed with Marcum LLP the accounting firm’s independence.

Based on the foregoing, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 for filing with the SEC.

Audit Committee

Mr. Rahul Mewawalla, Chairperson

Mr. Stephen Chen

Ms. Kathy Tan Mayor

Compensation Committee

Messrs. Chen, Costello and Mewawalla, each of whom is a non-employee member of the Board, currently comprise our Compensation Committee. We have determined that each member of our Compensation Committee meets the requirements for independence under the rules of Nasdaq and SEC rules and regulations. Ms. Mayor, who served on the Compensation Committee and as its Chairperson until her resignation, resigned as a Class II director effective October 26, 2023, at which time, Mr Costello will serve as Chairperson. During the fiscal year ended December 31, 2022, the Compensation Committee met four times. The Compensation Committee is responsible for, among other things:

•reviewing, approving and determining the compensation of executive officers and key employees;

•reviewing, approving and determining compensation and benefits, including equity awards, to directors for service on the Board or any committee thereof;

•administering equity compensation plans;

•reviewing, approving and making recommendations to the Board regarding incentive compensation and equity compensation plans; and

•establishing and reviewing general policies relating to compensation and benefits of the Company's employees.

The Board has adopted a written charter for the Compensation Committee that satisfies the applicable rules and regulations of the SEC and the listing standards of Nasdaq. Our Compensation Committee charter can be found on the "Governance Documents" section of our Investor Relations website at https://investors.phunware.com/governance-docs.

Compensation Committee Processes and Procedures

Typically, our Compensation Committee meets quarterly and with greater frequency, if necessary. The agenda for each meeting will usually be developed by the Chairperson of the Compensation Committee, in consultation with the Chief Executive Officer and the Chief Financial Officer. Our Chief Executive Officer may not be present during voting or deliberations of the Compensation Committee regarding his compensation but may participate in the review or determination of the compensation of each of the other executive officers. The Compensation Committee meets regularly in executive session. However, from time to time, various members of management and other employees as well as outside advisors or consultants may be invited by the Compensation Committee to make presentations, to provide financial or other background information or advice or to otherwise participate in Compensation Committee meetings.

The Compensation Committee has the right, in its sole discretion, to retain or obtain the advice of compensation consultants, independent legal counsel and other advisors. The Compensation Committee is directly responsible for the appointment and oversight of the work of any compensation consultant, independent legal counsel and other advisor retained by the Committee. Such responsibility includes the sole authority to retain or terminate, and to determine the terms of engagement and the extent of funding necessary for payment of reasonable compensation to, compensation consultants, independent legal counsel and other advisors retained by the Committee. The Company will provide appropriate funding for the payment of compensation to its compensation consultants, outside legal counsel and other advisors retained by the Compensation Committee.

The Compensation Committee may delegate its authority to subcommittees or the Chairperson of the Compensation Committee when it deems it appropriate and in the best interests of the Company and when such delegation would not violate applicable law, regulation or Nasdaq or SEC requirements (collectively, “Applicable Legal Requirements”). Subject to Applicable Legal Requirements, the Compensation Committee may also delegate to one or more officers of the Company the authority to make equity grants to employees or consultants of the Company who are not directors of the Company or executive officers of the Company under the Company’s equity plans as the Compensation Committee deems appropriate and in accordance with the terms of such plans and such guidelines as may be approved by the Compensation Committee.

In addition, should the Company cease to be a “smaller reporting company”, the Compensation Committee will review with management the Company’s Compensation Discussion and Analysis and consider whether to recommend that it be included in proxy statements and other filings.

Nominating and Corporate Governance Committee

Messrs. Costello, Chen and Mewawalla, each of whom is a non-employee member of our Board, currently comprise our Nominating and Corporate Governance Committee. Mr. Chen is the Chairperson of our Nominating and Corporate Governance Committee. We have determined that each member of our Nominating and Corporate Governance Committee meets the requirements for independence under the rules of Nasdaq. Ms. Mayor, who served on the Nominating and Corporate Governance Committee, resigned as a Class II director effective October 26, 2023. During the fiscal year ended December 31, 2022, the Nominating and Corporate Governance Committee met three times. The Nominating and Corporate Governance Committee is responsible for, among other things:

•identifying, evaluating and selecting or making recommendations to the Board regarding nominees for election to the Board and its committees;

•evaluating the performance of the Board and of individual directors;

•considering and making recommendations to the Board regarding the composition of the Board and its committees;

•reviewing developments in corporate governance practices;

•evaluating the adequacy of our corporate governance practices and reporting; and

•developing and making recommendations to the Board regarding corporate governance guidelines and matters.

The Nominating and Corporate Governance Committee believes that candidates for director should have the highest personal values, integrity and ethics, along with certain minimum qualifications, including individuals who have exhibited achievements and excellence in one or more of the key professional, business, financial, legal or other fields that we may encounter. Furthermore, the Nominating and Corporate Governance Committee also intends to consider such factors as possessing relevant expertise in the business environment in which we operate, ability to make independent analytical inquiries, willingness to devote sufficient time to Board duties, ability to serve on the Board for a sustained period and having the commitment to scrupulously represent the long-term interest of stockholders.

While the Board does not have a formal policy on diversity, the Nominating and Governance Committee endeavors to achieve an overall balance of diversity of experiences, skills, attributes and viewpoints among our directors. The Nominating and Governance Committee believes that appointing directors with a diverse range of expertise, backgrounds and skill sets fosters robust and insightful discussion amongst directors and provides our management with an invaluable opportunity to learn from a variety of unique perspectives and experiences. The Nominating and Governance Committee does not discriminate based upon race, religion, sex, national origin, age, disability, citizenship or any other legally protected status.

In identifying potential director candidates, the Nominating and Governance Committee solicits recommendations from existing directors and senior management to be considered by the Nominating and Governance Committee along with any recommendations that have been received from stockholders as discussed in more detail below. The Nominating and Governance Committee may also, in its discretion, retain, and pay fees to, a search firm to provide additional candidates.

For incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee reviews these directors’ overall service to the Company during their terms, including the number of meetings attended, level of participation, quality of performance and any other relationships and transactions that might impair the directors’ independence.

Any stockholder of the Company who desires to submit director nomination in next year’s proxy materials outside of the processes of Rule 14a-8 must make such submission in writing not earlier than August [__], 2024 and not later than September [__], 2024 to Phunware’s Secretary at 1002 West Avenue, Austin, Texas 78701 and comply with the requirements in the Company’s Amended and Restated Bylaws and all applicable requirements of Rule 14a-8 promulgated under the Exchange Act. However, if our 2024 Annual Meeting of Stockholders is held before November 20, 2024 or after February 18, 2025, then the deadline is not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of (i) the 90th day prior to such annual meeting, or (ii) the tenth day following the day on which Public Announcement (as defined in our Amended and Restated Bylaws) of the date of such annual meeting is first

made. You are also advised to review our Amended and Restated Bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations.

Any stockholder of the Company who desires to submit director nomination in next year’s proxy materials within the processes of Rule 14a-8 must make such submission in writing not later than June [__], 2024 to Phunware’s Secretary at 1002 West Avenue, Austin, Texas 78701. Any such stockholder proposal must meet the requirements set forth in Rule 14a-8.

With respect to any director candidate nominated by a stockholder or group of stockholders, the following information must be provided to the Company with the written nomination:

•the name and address of the nominating stockholder, as they appear on the Company’s books;

•the nominee’s name and address and other personal information;

•a description of all direct and indirect compensation and other material monetary agreements, arrangements and understandings during the past three years, and any other material relationships, between or among the nominating stockholder or beneficial owner and each proposed nominee;

•a completed and signed questionnaire, representation and agreement and written director agreement, pursuant to the Company’s Amended and Restated Bylaws, with respect to each nominee for election or re-election to the Board; and

•all other information required to be disclosed pursuant to the Company’s Amended and Restated Bylaws and Regulation 14A of the Exchange Act.

The Company may require any proposed director candidate to furnish such other information as may reasonably be required by the Company to determine the eligibility of such proposed candidate to serve as an independent director of the Board or that could be material to a reasonable stockholder’s understanding of the independence, or lack thereof, of such candidate. The Company suggests that any such proposal be sent by certified mail, return receipt requested.

The Board has adopted a written charter for the Nominating and Corporate Governance Committee that satisfies the applicable rules and regulations of the SEC and the listing standards of Nasdaq. Our Nominating and Corporate Governance Committee charter can be found on the "Governance Documents" section of our Investor Relations website at https://investors.phunware.com/governance-docs.

Non-Employee Director Compensation

We have a formal policy pursuant to which our non-employee directors would be eligible to receive equity awards and cash retainers as compensation for service on the Board and its committees. We also reimburse our directors for reasonable travel expenses associated with attending board and committee meetings.

Director Compensation

The following table sets forth certain information with respect to the compensation for our directors, excluding reasonable travel expenses, for the year ended December 31, 2022.

| | | | | | | | | | | | | | | | | | | | |

Name | | Fees Earned or

Paid in Cash ($) | | Stock Awards ($)(1) | | Total ($) |

Russell Buyse (2) | | 6,000 | | — | | 6,000 |

Stephen Chen (3) | | 13,542 | | 155,018 | | 168,560 |

| Ryan Costello | | 105,000 | | 113,368 | | 218,368 |

Keith Cowan (4) | | 120,556 | | — | | 120,556 |

Eric Manlunas (5) | | 108,750 | | 103,345 | | 212,095 |

Kathy Tan Mayor(6) | | 85,833 | | 103,345 | | 189,179 |

Rahul Mewawalla | | 107,500 | | 113,368 | | 220,868 |

| | | | | |

(1) | This column reflects the aggregate grant date fair value of restricted stock units granted during 2022 computed in accordance with the provisions of ASC 718, Compensation-Stock Compensation. The assumptions that we used to calculate these amounts are discussed in the notes to Phunware’s audited consolidated financial statements for the year ended December 31, 2022. These amounts do not reflect the actual economic value that will be realized by the director upon the vesting of the restricted stock units or the sale of the common stock underlying such restricted stock units. |

(2) | Mr. Buyse was appointed to our Board on November 21, 2022. For the period of November 21, 2022 through December 27, 2022, Mr. Buyse was paid $6,000 cash compensation for services he provided as a director. Commencing on December 28, 2022, the date at which Mr. Buyse was appointed our CEO, and thereafter, he did not receive any additional compensation for the services he provided as a director. For information on Mr. Buyse's compensation, please refer to "Executive Compensation." |

(3) | Mr. Chen was elected to our Board at our 2022 annual meeting of stockholders held on November 11, 2022 |

(4) | Mr. Cowan's term expired at our 2022 annual meeting of stockholders held on November 11, 2022. |

(5) | Mr. Manlunas resigned from our board effective October 1, 2023. |

(6) | Ms. Mayor resigned from our board effective October 26, 2023. |

Outstanding Equity Awards as of Fiscal Year-End

The following table sets forth the aggregate number of shares subject to outstanding equity awards held by our non-employee directors as of December 31, 2022:

| | | | | | | | | | | | | | | | | | | | |

| | Restricted Stock Unit Awards |

| | Grant date | | Number of shares or units of stock that have not vested (#) | | Market value of shares or units of stock that have not vested ($) |

Stephen Chen (1) | | 11/14/2022 | | 104,742 | | 80,966 |

Ryan Costello (2) | | 11/14/2022 | | 76,600 | | 59,212 |

Eric Manlunas (1) | | 11/14/2022 | | 69,828 | | 53,977 |

Kathy Tan Mayor (1) | | 11/14/2022 | | 69,828 | | 53,977 |

Rahul Mewawalla (2) | | 11/14/2022 | | 76,600 | | 59,212 |

| | | | | |

(1) | The Restricted Stock Units ("RSUs") vest in four equal installments commencing on February 11, 2023, and quarterly thereafter until the final vesting date of November 11, 2023. Vesting is subject to the continued service on such vesting date. |

(2) | The RSUs vest in four equal installments commencing on January 1, 2023, and quarterly thereafter until the final vesting date of October 1, 2023. Vesting is subject to the continued service on such vesting date. |

Employee, Officer and Director Hedging

Our Insider Trading Policy and Guidelines with Respect to Certain Transactions in Securities applicable to all directors, officers, employees and agents of the Company prohibits such parties from engaging in transactions in publicly-traded options, such as puts and calls, and other derivative securities with respect to the Company’s securities. This prohibition extends to any hedging or similar transaction designed to decrease the risks associated with holding Company securities. Stock options, stock appreciation rights and other securities issued pursuant to Company benefit plans or other compensatory arrangements with the Company are also subject to this prohibition; provided, however, such parties are not prohibited from exercising any stock options issued under any of the Company’s benefit plans or other compensatory arrangements in accordance with the terms of such plans or arrangements.

EXECUTIVE COMPENSATION

Phunware’s named executive officers ("NEOs"), which consist of the person or persons who served as our principal executive officer ("PEO") and the next two most highly compensated executive officers who served as executive officers during the year ended December 31, 2022, are:

Russel Buyse, Chief Executive Officer

Alan Knitowski, Chief Executive Officer

Matt Lull, Chief Cryptocurrency Officer

Chris Olive, Chief Legal Officer

Summary Compensation Table

The following table sets forth information regarding the total compensation of our NEOs for the years ended December 31, 2022 and 2021:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | | Fiscal Year | | Salary ($)(1) | Bonus ($) | | Stock Awards ($)(2) | | All Other Compensation ($)(3) | | Total ($) |

Russell Buyse, Chief Executive Officer (4) | | 2022 | | 3,693 | | | 40,000 | | | — | | | — | | | 43,693 | |

Alan Knitowski, Chief Executive Officer (5) | | 2022 | | 550,000 | | | — | | | — | | | 25,693 | | | 575,693 | |

| | 2021 | | 375,000 | | | 450,000 | | | 1,613,570 | | | 20,384 | | | 2,458,954 | |

Matt Lull, Chief Cryptocurrency Officer (6) | | 2022 | | 212,500 | | | — | | | 615,000 | | | 10,088 | | | 837,588 | |

Chris Olive, Chief Legal Officer (7) | | 2022 | | 225,000 | | | 34,907 | | | 925,000 | | | 19,270 | | | 1,204,177 | |

| | | | | |

(1) | Reflects actual earnings, which may differ from approved based salaries due to the effective date of salary increases. |

(2) | Amounts represent the aggregate grant date fair value of stock options or restricted stock unit awards, computed in accordance with FASB ASC 718-10-25. The actual value realized by the named executive officer with respect to stock awards will depend on whether the award vests and, if it vests, the market value of our stock on the date such stock is sold. |

(3) | Amounts shown in this column include contributions Phunware made on behalf of the named executive officer for inclusion in our medical benefits programs. |

(4) | Mr. Buyse was hired as our CEO effective as of December 28, 2022. Mr. Buyse received additional compensation of $6,000 for service on our Board for the period from November 21, 2022 to December 27, 2022, which is excluded above. Subsequent to the date of his appointment as CEO, Mr. Buyse did not receive additional compensation as a member of our Board. See "Director Compensation" above. Mr. Buyse was further paid a sign-on bonus of $40,000, pursuant to the terms of his employment agreement. Mr. Buyse's employment with the Company terminated on October 25, 2023. |

(5) | Mr. Knitowski's employment terminated with the Company on December 27, 2022. |

(6) | Mr. Lull joined the Company as its Chief Cryptocurrency Officer on April 18, 2022. His employment subsequently terminated with the Company effective May 30, 2023. |

(7) | Mr. Olive joined the Company as its Chief Legal Officer on April 1, 2022. |

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth information regarding outstanding stock options and other equity awards held by each of our named executive officers as of December 31, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Options Awards | | Restricted Stock Unit Awards |

| | Grant Date | | Number of Securities Underlying Unexercised Options | | Option Exercise Price | | Option Expiration Date | | Number

of shares or

units of stock

that have

not vested

(#) | | Market value

of shares or

units of stock

that have

not vested

($) |

| Name | | | Exercisable | | Unexercisable | | | | |

| Alan Knitowski | | 1/8/2018 | | 233,886 | | | — | | | 0.61 | | | 1/8/2028 | | — | | | — | |

| | 7/30/2019 | | — | | | — | | | — | | | — | | | 37,500 | | (1) | 28,988 | |

| | 2/4/2021 | | — | | | — | | | — | | | — | | | 435,763 | | (1) | 336,845 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Matt Lull | | 9/28/2022 | | — | | | — | | | — | | | — | | | 500,000 | | (2) | 386,500 | |

| Chris Olive | | 9/16/2022 | | — | | | — | | | — | | | — | | | 500,000 | | (3) | 386,500 | |

| | | | | |

(1) | Mr. Knitowski was granted 450,000 restricted stock units on July 30, 2019. The restricted stock units will vest at various rates with of 1/4th vesting on May 18, 2020, and thereafter at a rate of 1/12th on the following vesting dates; August 18 2020, November 18, 2020, May 18, 2021, August 18, 2021, November 18, 2021, May 18, 2022, August 18, 2022, November 18, 2022 and May 18, 2023, subject to his continued employment with the Company on each such vesting date. Mr. Knitowski was also granted 747,023 restricted stock units on February 4, 2021. The restricted stock units vest at various rates with 1/4th vesting on May 9, 2022, and thereafter at a rate of 1/12th on the following vesting dates; August 8, 2022, November 8, 2022, May 8, 2022, August 8, 2022, November 8, 2022, May 8, 2023, August 8, 2023, November 8, 2023 and May 8, 2024, August 8, 2024, November 8, 2024, May 8, 2025, subject to his continued employment with the Company on each such vesting date. As of December 27, 2022, Mr. Knitowski had approximately 473,263 unvested restricted stock units under the aforementioned grants. As additional compensation under the terms of a Confidential Transition, Consulting and General Release Agreement, the Company modified the vesting schedule with respect to the unvested portion of restricted stock units, such that 39,438 restricted stock units will vest on each of the last day of each month from January 2023 through November 2023 and 39,445 restricted stock units will vest on December 31, 2023. |

| |

(2) | Mr. Lull was granted 500,000 restricted stock units on September 28, 2022. The restricted stock units vest at various rates with 135,417 restricted stock units vesting on May 8, 2023, 40,510 restricted stock units vesting on each of August 8, 2023 and November 8, 2023 and 40,509 restricted stock units vesting on each of May 8, 2024, August 8, 2024, November 8, 2024, May 8, 2025, August 8, 2025, November 8, 2025 and April 17, 2026, subject to his continued employment with the Company on each such vesting date. |

(3) | Mr. Olive was granted 500,000 restricted stock units on September 16, 2022. The restricted stock units vest at various rates with 135,417 restricted stock units vesting on May 8, 2023, 40,510 restricted stock units vesting on each of August 8, 2023 and November 8, 2023 and 40,509 restricted stock units vesting on each of May 8, 2024, August 8, 2024, November 8, 2024, May 8, 2025, August 8, 2025, November 8, 2025 and March 31, 2026, subject to his continued employment with the Company on each such vesting date. |

Executive Employment Agreements

We entered into employment agreements with the named executive officers noted above, of which only Chris Olive remains currently employed by the Company. The employment agreements with our NEOs generally provide for at-will employment and set forth each named executive officer's base salary, bonus target, severance eligibility and eligibility for other standard employee benefit plan participation.

Pursuant to the employment agreements, certain current and future significant employees, including the named executive officers identified above, are eligible for severance benefits under certain circumstances. The actual amounts that would be paid or distributed as a result of a termination of employment occurring in the future may be different than those presented below as many factors will affect the amount of any payments and benefits upon a termination of employment. For example, some of the factors that could affect the amounts payable include base salary and annual bonus target percentage. Although the Company has entered into a written agreement to provide severance payments and benefits in connection with a termination of employment under particular circumstances, the Company, or an acquirer, may mutually agree with an executive officer or significant employee to provide payments and benefits on terms that vary from those currently contemplated. In addition to the amounts presented below, each eligible executive officer or significant employee would also be able to exercise any previously-vested stock options that he or she held, in accordance with the terms of those grants and the respective plans pursuant to which they were granted. Finally, the eligible executive officer or significant employee may also receive any benefits accrued under our broad-based benefit plans, in accordance with those plans and policies.

Mr. Olive's Employment Agreement

We entered into an employment agreement, as amended and restated in September 2022, with Chris Olive, who serves as our Chief Legal Officer. The agreement has an initial term of four years from his April 2022 hire date and automatically renews for additional one year terms, unless either party provides ninety (90) day notice. If a change in control, as defined the agreements, occurs when there are fewer than twelve (12) months remaining during the initial term or an additional term, the term of the employment agreement will extend automatically through the date that is twelve (12) months following the effective date of the change in control.

The employment agreement provides for an initial base salary of $300,000, eligibility in the Company's bonus programs established by the Board or any committee of the Board, and eligibility to participate in our employee benefit programs. Under the terms of his employment agreement the Company provided Mr. Olive a one-time grant of 500,000 restricted stock units on September 16, 2022. The restricted stock units granted to Mr. Olive are subject to a separate award agreement, which outlines the specifics of such grant, including but not limited to, the vesting schedule, forfeiture for cause provisions, the Company’s buyback rights and other restrictions and terms.

Termination without Cause or Resignation for Good Reason Outside the Change in Control Period

Mr. Olive is eligible to receive the following payments and benefits in connection with a termination not in connection with a Change in Control:

•continuing payments of severance pay at a rate equal to their base salary rate, as then in effect, for six (6) months from the date of termination;

•coverage under our group health insurance plans or payment of the full amount of health insurance premiums as provided under the Consolidated Omnibus Budget Reconciliation Act (“COBRA”) for up to six (6) months after termination; and

•the immediate vesting of all equity awards granted on or after the effective date of the employment agreement.

Termination Without Cause or Resignation for Good Reason During the Change in Control Period

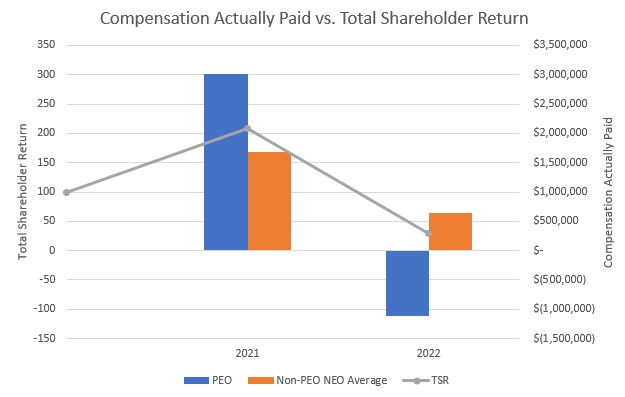

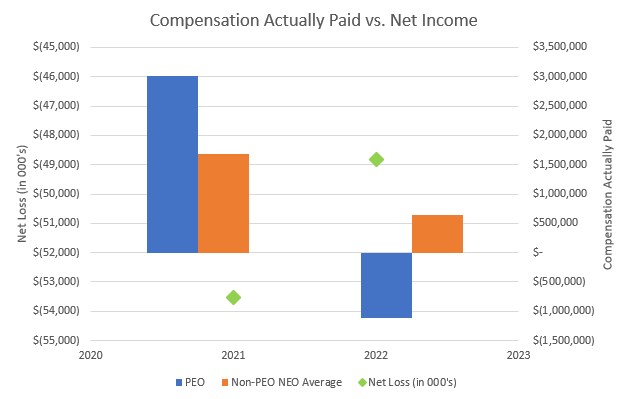

In the case of a Change in Control, if Mr. Olive is terminated without cause, either during the three months before or in the year after a Change in Control, then he will be entitled to receive the following payments and benefits: